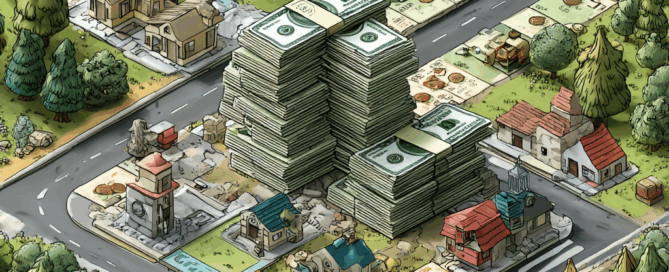

Tax Notices Come With a Timer: What You Need to Know Before It’s Too Late

One of the most common — and costly — mistakes taxpayers make is waiting too long to respond to a tax notice. Across federal and state tax systems, the time allowed to challenge an income tax assessment is strict, jurisdictional, and unforgiving. Missing a deadline often means the assessment becomes final, regardless of merit. Below