LATEST NEWS

Setting up a Childcare facility for employees? Claim the $150k credit

In the Tax Tip 2024-58, the IRS gave details about

Hard time to get in contact with the IRS? The IRS only answers around 31% of calls

In the mid year report to Congress (IR-2024-173), National Taxpayer Advocate Erin M. Collins revealed the misleading metrics

NJ Supreme Court Committee Issues Opinion allowing CPAs and EAs to assist in simple BOI filings

Two days ago, the Committee on the Authorized Practice of Law appointed by the Supreme Court of New

Around 22 months delay to resolve identity theft – Consider the IRS Identity Protection PIN

In the mid year report to Congress, National Taxpayer Advocate Erin M. Collins stated that there are significant

Higher audit rates for partnerships and scrutiny on basis shifting

In the Fact Sheet 2024-21 Basis shifting, the IRS detailed the guidance to avoid abusive basis shifting by

MORE NEWS

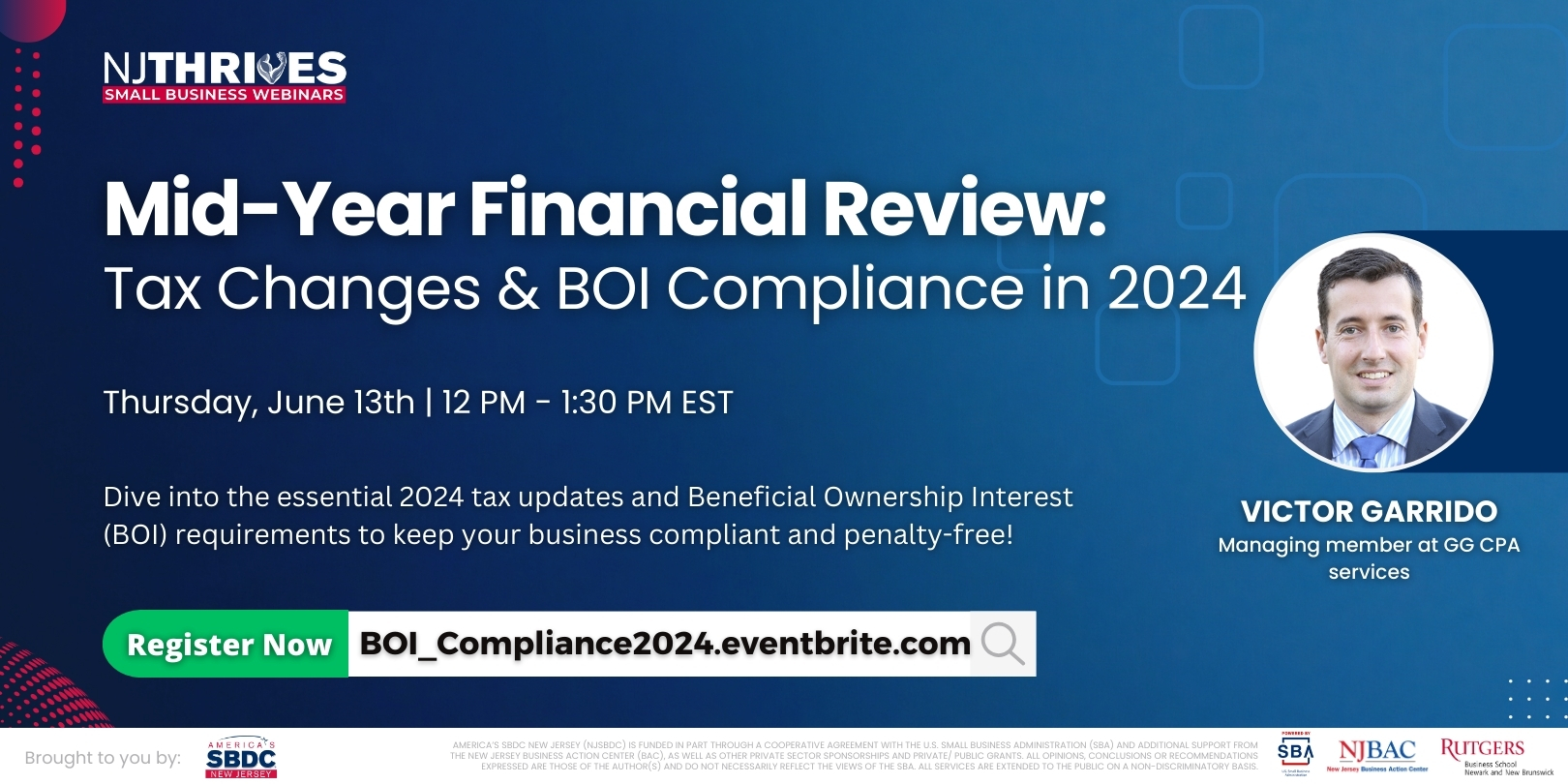

Mid-year Financial review – Tax changes & BOI compliance – Recording available in YouTube

Our colleagues from NJ SBDC have posted the Mid-year Financial review seminar from mid-June 2024 in Youtube. We highly recommended checking the

Do not rely on Tiktok tax advice – Check with a reputable professional!

In mid June 2024, Victor Garrido attended an IRS conference "Working Together" where the IRS made presentations on several topics. One of

Bipartisan Budget Act of 2015 first results of partnership audit procedures

As the IRS is increasing the attention on partnership returns, especially those with higher asset value or more complexity, we should keep