The ITIN (Individual Tax Identification Number) is a tax processing number only available for certain nonresident and resident aliens, their spouses, and dependents who cannot get a Social Security Number (SSN). It is a 9-digit number, beginning with the number “9”, formatted like an SSN (NNN-NN-NNNN).

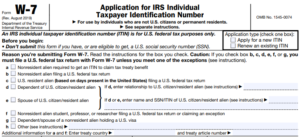

To obtain the ITIN number, you need an appropriate reason and click on one of the boxes, and in some cases, submit a U.S. federal tax return with Form W-7.

Each ITIN applicant must:

- Apply using the revised Form W-7, Application for IRS Individual Taxpayer Identification Number; and

- Attach a federal income tax return to the Form W-7.

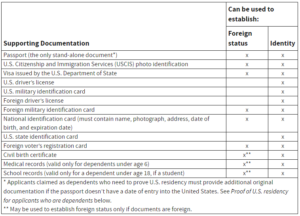

In addition to the previous points, the instructions list the supporting documentation requirements (original documents or certified copies)

Applicants who meet one of the exceptions to the requirement to file a tax return must provide documentation to support the exception.

You may either mail the documentation, along with the Form W-7, to the address shown in the Form W-7 Instructions, present it at IRS walk-in offices, or process your application through an Acceptance Agent authorized by the IRS.

Useful Links

Location of acceptance agents – https://www.irs.gov/individuals/international-taxpayers/acceptance-agent-program

Link Form w7 – https://www.irs.gov/forms-pubs/about-form-w-7

Link Form w7 instructions – https://www.irs.gov/instructions/iw7