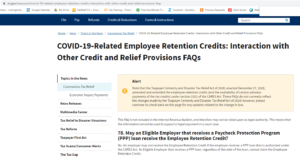

The Employee Retention Credit (ERC) is one of the most complex tax credits in these stimulus packages. Initially, you could not get PPP and the employer retention credit. There was a previous post that discussed this matter. Now, it seems that the IRS is addressing only if no forgiveness PPP is available to the business owner. In fact, the old guidance is still on the IRS website at the time of this post. See image below from the IRS guidance – FAQs.

“78. May an Eligible Employer that receives a Paycheck Protection Program (PPP) loan receive the Employee Retention Credit?

No. An employer may not receive the Employee Retention Credit if the employer receives a PPP loan that is authorized under the CARES Act. An Eligible Employer that receives a PPP loan, regardless of the date of the loan, cannot claim the Employee Retention Credit.”

As mentioned before, in new guidance published by the IRS this week (links at the end of this post), the IRS stated that “Retroactive to the March 27, 2020, enactment of the CARES Act, the law now allows employers who received Paycheck Protection Program (PPP) loans to claim the ERC for qualified wages that are not treated as payroll costs in obtaining forgiveness of the PPP loan.”

In addition to that change, the IRS guidance indicates that “Effective January 1, 2021, employers are eligible if they operate a trade or business during January 1, 2021, through June 30, 2021, and experience either:

- A full or partial suspension of the operation of their trade or business during this period because of governmental orders limiting commerce, travel or group meetings due to COVID-19, or

- A decline in gross receipts in a calendar quarter in 2021 where the gross receipts of that calendar quarter are less than 80% of the gross receipts in the same calendar quarter in 2019 (to be eligible based on a decline in gross receipts in 2020 the gross receipts were required to be less than 50%).

In addition, effective January 1, 2021, the definition of qualified wages was changed to provide:

- For an employer that averaged more than 500 full-time employees in 2019, qualified wages are generally those wages paid to employees that are not providing services because operations were fully or partially suspended or due to the decline in gross receipts.

- For an employer that averaged 500 or fewer full-time employees in 2019, qualified wages are generally those wages paid to all employees during a period that operations were fully or partially suspended or during the quarter that the employer had a decline in gross receipts regardless of whether the employees are providing services. “

At the time of this post, the IRS gives specific instructions to claim this credit if no PPP forgiveness was allowed. No reference to if PPP forgiveness was allowed or calculations for partial forgiveness. In fact, the name of the post (link right below) is “Didn’t Get Requested PPP Loan Forgiveness? You Can Claim the Employee Retention Credit for 2020 on the 4th Quarter Form 941”

Link Employee Retention Credit – https://www.irs.gov/forms-pubs/didnt-get-requested-ppp-loan-forgiveness-you-can-claim-the-employee-retention-credit-for-2020-on-the-4th-quarter-form-941

Note that the ERC is allowed against the employer’s share of Social Security taxes and the credit is fully refundable. If the credit exceeds the employer’s total liability of the portion of Social Security tax in any calendar quarter, the excess is refunded to the employer. At the end of the quarter, the amount of these credits will be reconciled on the employer’s Form 941. Consequently, we assume that this credit should be communicated to your payroll company as they input the 941 and provide details of the credits that you are requesting.

The Journal of Accountancy made echo of all these changes and that CPA professionals (AICPA) are waiting for further guidance from the IRS and Treasury. Some extracts of their article below:

“… The Consolidated Appropriations Act, 2021, P.L. 116-260, extends the Coronavirus Aid, Relief, and Economic Security (CARES) Act, P.L. 116-136, ERC through June 30, 2021. It also expands the ERC and makes technical corrections. The expansions of the credit include:

- An increase in the credit rate from 50% to 70% of qualified wages;

- An increase in the limit on per employee creditable wages from $10,000 for the year to $10,000 for each quarter;

- A reduction in the required year-over-year gross receipts decline from 50% to 20%;

- A safe harbor allowing employers to use prior-quarter gross receipts to determine eligibility;

- A provision to allow certain governmental employers to claim the credit;

- An increase from 100 to 500 in the number of employees counted when determining the relevant qualified wage base; and

- Rules allowing new employers who were not in existence for all or part of 2019 to be able to claim the credit.

… The AICPA has requested guidance from the IRS and Treasury providing that the filing of a PPP loan forgiveness application does not constitute an election to forgo the ERC with respect to the amount of wages reported on the application exceeding the amount of wages necessary for loan forgiveness.”

Link IRS – New guidance – https://www.irs.gov/newsroom/new-law-extends-covid-tax-credit-for-employers-who-keep-workers-on-payroll

Link Journal of Accountancy – Request for further clarification – https://www.journalofaccountancy.com/news/2021/jan/employee-retention-credit-changes-questions.html

Link CPA Practice – https://www.cpapracticeadvisor.com/tax-compliance/news/21207462/covid-tax-credit-extended-for-employers-who-keep-workers-on-payroll