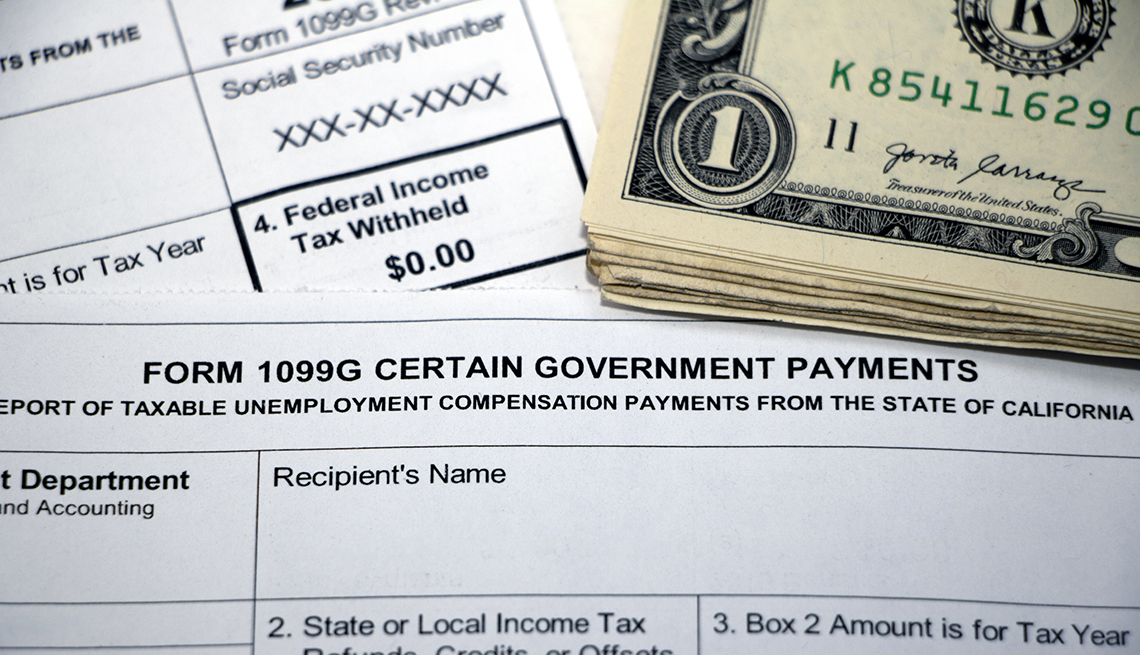

The American Rescue Plan includes a tax break for unemployed workers for the first $10,200 if the earnings are under $150k.

This new tax break has been available after some taxpayers have already filed their personal tax return. As a result, in some cases, the taxpayers might have to file an amended return (1040X) to offset the $10,200 in employment benefits (1099-G).

Tax professionals are waiting for IRS guidance as they might provide a simplified process to claim that $10,200 reduction in income or specific tax form to fill out. Also, if there will be a new form instead of filing the 1040 amended tax return for the 2020 year.

Link – https://www.cbsnews.com/news/unemployment-benefits-tax-exempt-american-rescue-plan/

Update 3/18/21 – Do not file an amended tax return (1040X) as the IRS is finalizing guidance on this subject. Initial information is pointing to a one page tax form to reduce the taxable income and potentially receive a refund. Note that the IRS has been back logged still processing 2019 returns, so having to deal with a few million 2020 amended tax returns might not be a great idea.

Link – https://www.cnbc.com/select/how-to-file-amended-tax-return-2020-covid-bill/