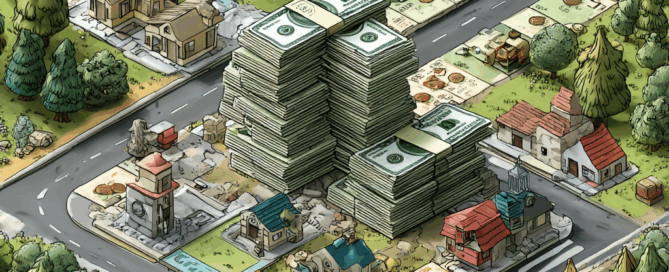

Avoid Tax Pitfalls and Maximize Gains: 4 Key Investment Tactics

There are many tax strategies that are overlooked levers for improving investment outcomes. Reviewing a client’s tax return isn't just a compliance exercise—it’s an opportunity to identify meaningful, actionable ways to reduce tax drag and improve long-term financial outcomes. When integrated with a thoughtful investment plan, tax planning becomes a powerful tool to grow and