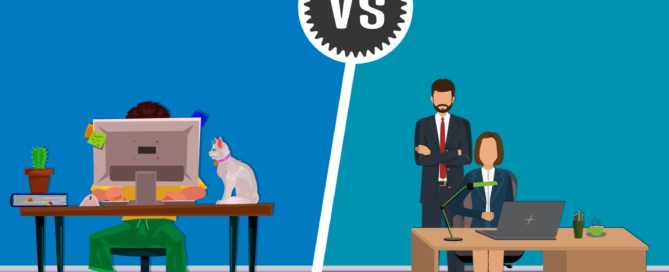

Employee (w2) vs Independent contractor (1099)

The designation of Employee (w2) vs Independent contractor (1099) is not up to the free will of the parties. It has to follow regulations released by the IRS, DOL, and State authorities. Some business owners might consider that independent contractors might be less costly as there is no employer portion, no payroll processing fees, no workers