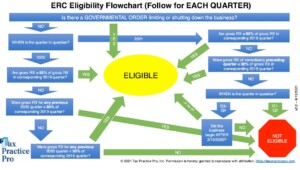

In August 2021, there have been several updates to the Employee Retention Credit guidance plus the National Conference of CPA Practitioners was extremely critical with some of this recent guidance. As you can read on this post, there are still different areas of this tax credit that are litigious and unclear for tax professionals. We have added some flowcharts, either images or links to the relevant flowcharts are below, that helps putting in plain English how the eligibility works, but we highly recommend contacting a professional to maximize the ERC.

On August 4, 2021, the Treasury and the IRS released Notice 2021-49 amplifies prior guidance regarding the employee retention credit provided in Notice 2021-20 and Notice 2021-23. This Notice addresses changes made by the American Rescue Plan Act of 2021 (ARP) to the employee retention credit that are applicable to the third and fourth quarters of 2021. Under the new notice, an ERC may be claimed by an eligible employer for qualified wages paid in the third and fourth calendar quarters of 2021. An eligible employer is an employer carrying on a trade or business (1) whose trade or business’s operation is fully or partially suspended due to orders from a governmental authority limiting commerce, travel, or group meetings due to COVID-19; (2) that experiences a decline in gross receipts (as defined in Notices 2021-20 and 2021-23); or (3) is a recovery startup business.

On August 10, 2021, the Treasury and the IRS released Revenue Procedure 2021-33 that provides safe harbor excluding certain amounts from gross receipts, such as: a) PPP loan, b) Shuttered Venue Operators Grants, and c) Restaurant Revitalization Grants.

On August 11, 2021, as reported in the News in Accounting Today, the National Conference of CPA Practitioners has issued a call to action criticizing the Internal Revenue Service’s recent guidance around the Employee Retention Credit. The article pointed the following:

“Not having an allowance for those long-time family member employees and children was already a difficult pill for a small-business owner to swallow,” NCCPAP said today in an open letter signed by its president, Mark Stewart, and the co-chairs of its tax policy committee, Stephen Mankowski and Sanford Zinman. They note, though, that the new guidance takes a “letter of the law” approach that excludes the owner and their spouse’s wages if they have any “close living relatives,” regardless of whether they work for the company or not. “It does not have to be a relative you employ; the existence of any living relative disqualifies a small-business owner and their spouse from claiming an ERC on their earnings,” they wrote. “You read that correctly!”

Eligibility ERC (please review flowcharts)

Year 2020 (oversimplified response) – Eligible if a) fully or partially suspended or b) 50% Reduction in business receipts (i.e. gross sales / bank deposits / …) Then, the Eligible Wages for 2020 are capped at $10,000 per year (Maximum credit per employee is $5,000 – 50% ERC).

Year 2021 (oversimplified response) – Eligible if a) fully or partially suspended or b) 50% Reduction in business receipts (i.e. gross sales / bank deposits / …) Then, the Eligible Wages for 2021 are capped at $10,000 per quarter (Maximum credit per employee is $7,000 per quarter – 70% ERC, so $21,000 in 2021).

In order to obtain the ERC, you need to coordinate with your payroll company and file an amended 941-X. Additionally, some payroll companies are allowing adjustments to the 2021 Q3 and 2021 Q4 so the 941 form already contains the ERC information (no need to amend then).

Note that you cannot double count if you got other support for payroll, like funds from PPP, taxpayers are allowed to “cherry pick” wages in a manner that allows them to maximize the retention credit and taxpayers can’t count the same wages and health insurance used for PPP

forgiveness also for the employee retention credit. These points, and many more, were clarified on the Wolters Kluwer document called “Maximizing the Employee Retention Credit FAQ”, which was extremely helpful on unclear areas and expressed some of the instructor’s interpretations.

Furthermore, it is extremely relevant to mention that the current infrastructure bill (1 trillion package) would end the ERTC three months earlier (ending in Sept. 30 instead of Dec. 31, 2021 – removal of 2021 Q4). See further details in the link below.

We are aware that this is a complex topic, so please, search for reputable and professional tax guidance from CPAs, EAs, attorneys or other professionals. Once the eligibility and potential ERC has been calculated, communicate with your payroll provider.

Employee Retention Credit eligibility from Tax Practice Pro Inc:

Withum – Flowchart 2020 – https://www.withum.com/wp-content/uploads/2021/01/Employee-Retention-Credit-2020-Flowchart.pdf

Withum – Flowchart 2021 – https://www.withum.com/wp-content/uploads/2021/01/Employee-Retention-Credit-2021-Flowchart.pdf

Link FAQs ERC – IRS website – https://www.irs.gov/newsroom/faqs-employee-retention-credit-under-the-cares-act

Link JoA – Update Notice 2021-49 (Aug 4, 2021) – https://www.journalofaccountancy.com/news/2021/aug/irs-updates-employee-retention-tax-credit.html

Link JoA – Infrastructure bill would end ERC… – https://www.journalofaccountancy.com/news/2021/aug/infrastructure-bill-tax-provisions.html

Link SHRM – Infrastructure bill would cut ERTC short – https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/infrastructure-bill-would-cut-the-employee-retention-tax-credit-short.aspx