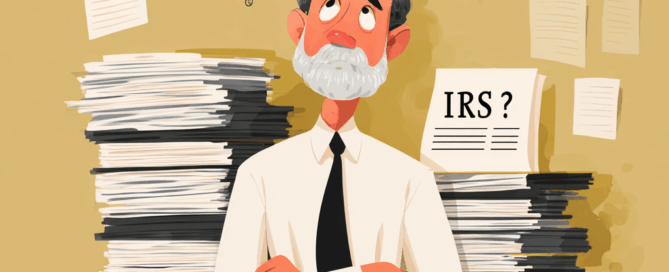

IRS payment options if you cannot pay in full

In the IRS Tax Tip 2025-29, the IRS reminds taxpayers that there are options available to those who can’t pay in full. Pay now (or by the tax deadline) Short term payment plan – 180 days or less – Individuals: Benefits $0 set if applied online, phone, in person or mail Long term payment plan