LATEST NEWS

Tax Notices Come With a Timer: What You Need to Know Before It’s Too Late

One of the most common — and costly — mistakes

Philadelphia Is Changing Its Business Taxes — Don’t Overreact, But Don’t Ignore This

Philadelphia Business Tax Changes: What Business Owners Really Need to Know In the last few months, I have

OBBBA Meets the States: Which Tax Systems Conform—and Which Break Away?

In our recent blog posts, we covered the federal impact of the One Big Beautiful Bill Act (OBBBA).

Qualifying as a Real Estate Professional: What It Means and Why It Matters for Tax Planning

Under default IRS rules, rental real estate activities are considered passive, regardless of how much time the taxpayer

Don’t Get Penalized This Holiday Season: Make Your RMD on Time

As the year wraps up and everyone’s busy before New Year’s Eve, the IRS has one more reminder

MORE NEWS

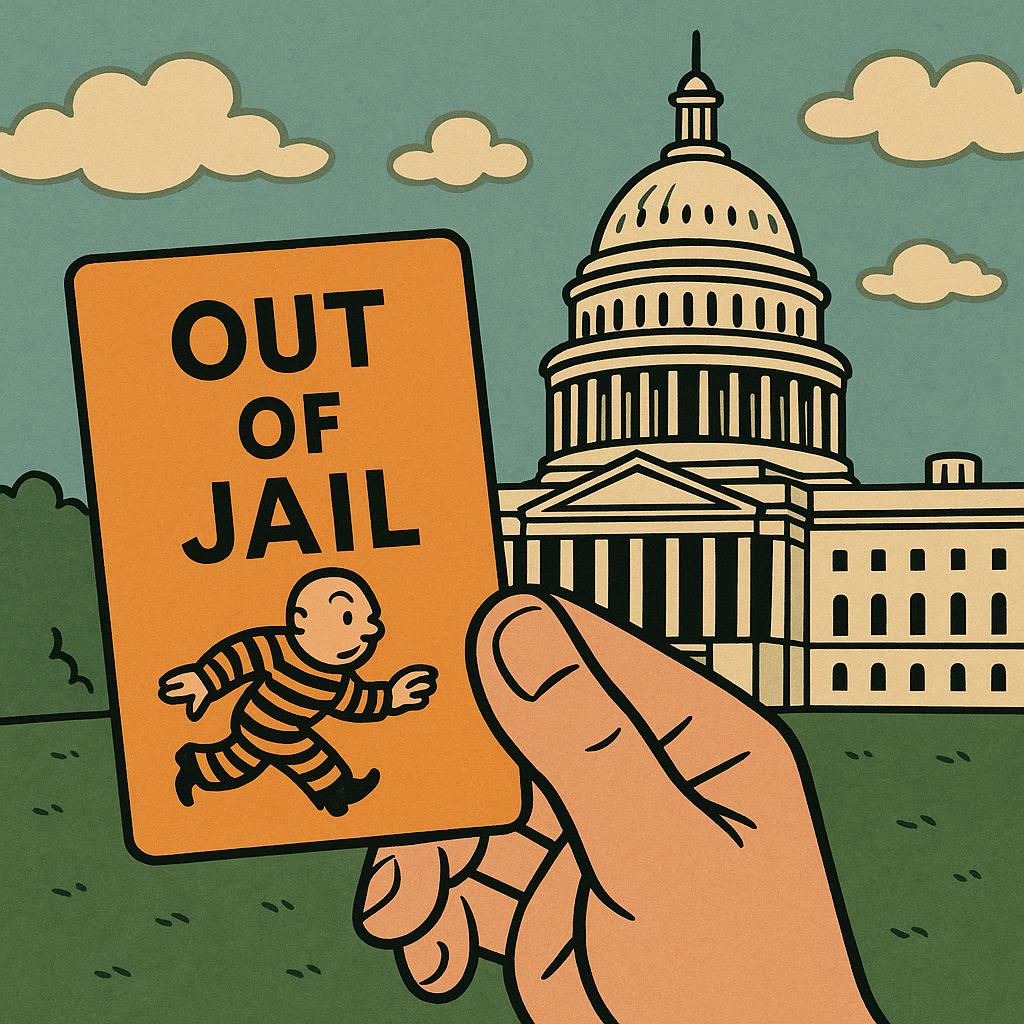

The IRS Came Bearing Gifts: Expanded Penalty Relief for 2026

As we wrap up another year and prepare our checklists for 2026 tax season, it turns out the IRS has been working

Smart Business-Owners Should Accelerate Charitable Gifts in 2025 Before New Rules Cut the Tax-Benefit

As we approach year-end, savvy business owners and high-income individuals should consider one important strategic move: accelerating charitable donations in 2025. Why?

IRS Restores $20,000 / 200-Transaction Rule for Form 1099-K in 2025

When Congress passed the American Rescue Plan Act (ARPA) in 2021, it lowered the Form 1099-K reporting threshold to $600 — with