We have been informing some of our client to be aware that unemployment is taxable. Otherwise, you can get an unpleasant surprise in next year’s taxes.

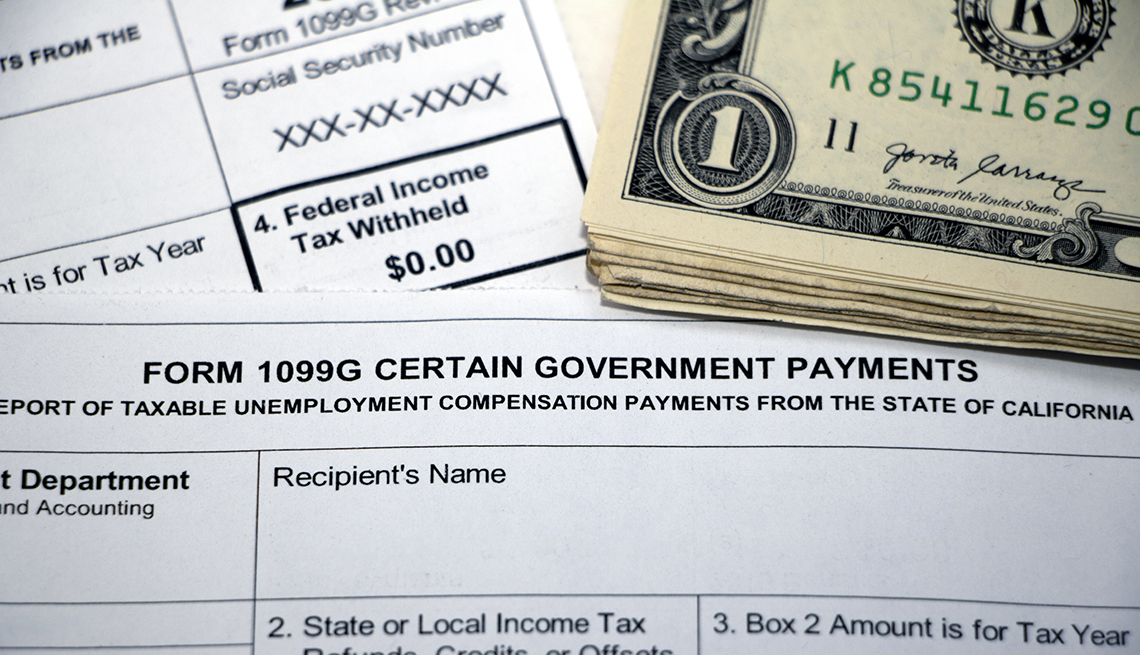

Any State or Federal unemployment received will be taxable and you should received a 1099 – G (Certain Government Payments) tax form in the mail.

You will owe taxes based on your ordinary income tax rate. Our recommendation is to make sure to withhold based on your estimated effective tax rate or be ready for the tax due, if any.

Link 1099 G IRS – https://www.irs.gov/forms-pubs/about-form-1099-g