Dive into the essential 2024 tax updates in this Presidential election year and Beneficial Ownership Interest (BOI) requirements to keep your business compliant and penalty-free!

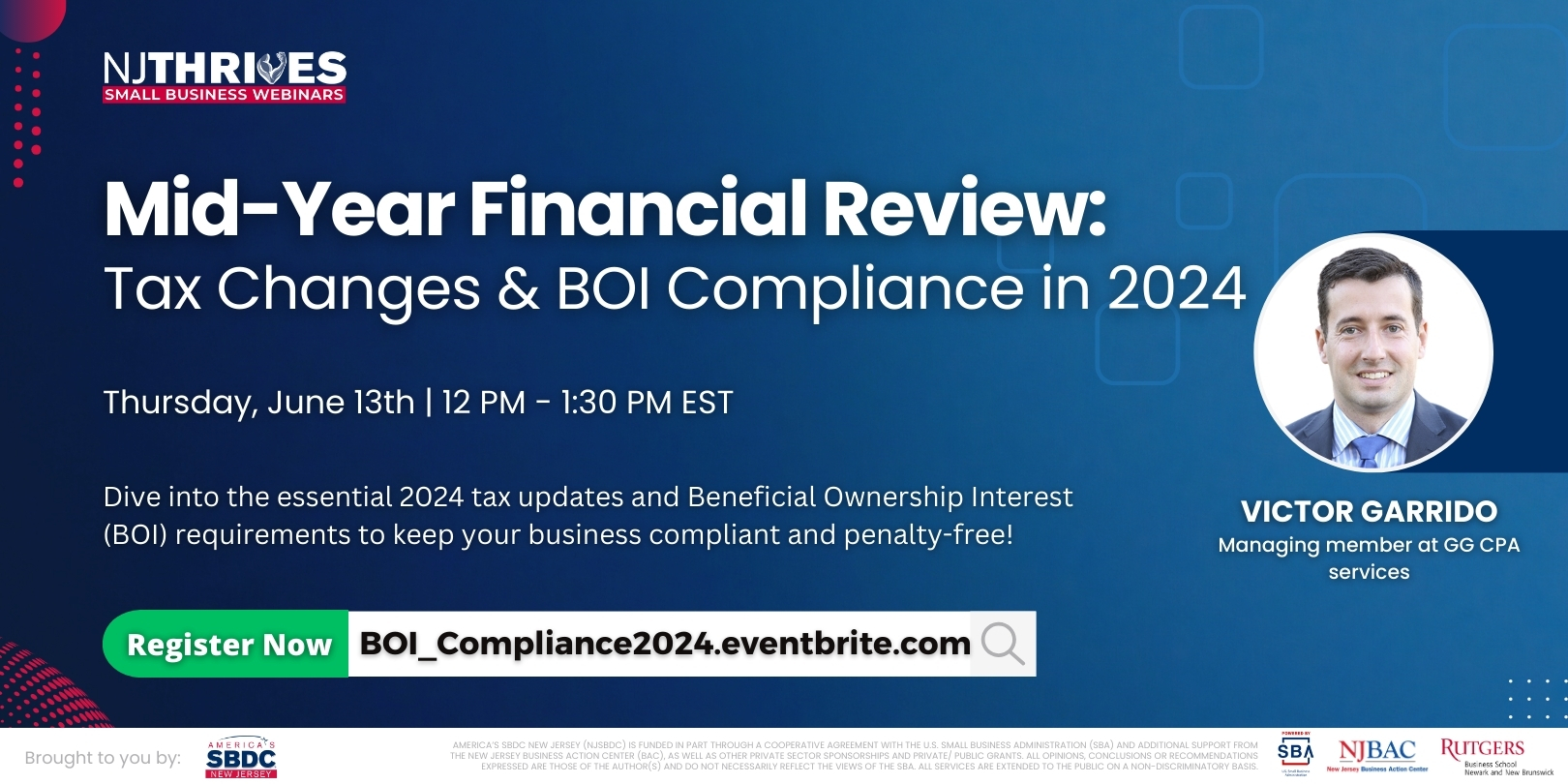

Join our friends at NJ SBDC this next Thursday, June 13th at 12 PM EST for our next event, “Mid-Year Financial Review: Tax Changes & BOI Compliance in 2024”, a critical session on the latest tax changes and the complexities of BOI as outlined by the FinCen requirement, led by Victor Garrido, Managing Member at GG CPA Services.

What You’ll Learn:

- Key tax changes for 2024 that could impact your business operations.

- Effective strategies to stay compliant and avoid IRS scrutiny.

- Insights into Beneficial Ownership Interest requirements to meet new federal regulations.

- Practical tips to dodge fines and penalties linked with BOI non-compliance.