The IRS in their Tax Tip 2020-14 communication provided some tips to choose a reputable tax preparer.

Check the preparer’s qualifications. People can use the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications. This tool helps taxpayers find a tax return preparer with specific qualifications. The directory is a searchable and sortable listing of preparers.

Check the preparer’s history. Taxpayers can ask the local Better Business Bureau about the preparer. Check for disciplinary actions and the license status for credentialed preparers. There are some additional organizations to check for specific types of preparers:

- Enrolled Agents: Go to the verify enrolled agent status page on IRS.gov.

- Certified Public Accountants: Check with the State Board of Accountancy.

- Attorneys: Check with the State Bar Association.

Ask about service fees. People should avoid preparers who base fees on a percentage of the refund or who boast bigger refunds than their competition.

Ask to e-file. To avoid pandemic related paper delays, taxpayers should ask their preparer to file electronically and choose direct deposit.

Make sure the preparer is available. Taxpayers may want to contact their preparer after this year’s April 15 due date.

Provide records and receipts. Good preparers will ask to see a taxpayer’s records and receipts. They’ll ask questions to figure things like the total income, tax deductions and credits.

Never sign a blank return. Taxpayers should not use a tax preparer who asks them to sign a blank tax form.

Review before signing. Before signing a tax return, the taxpayer should review it. They should ask questions if something is not clear. Taxpayers should feel comfortable with the accuracy of their return before they sign it.

Review details about any refund. Taxpayers should confirm the routing and bank account number on their completed return if they’re requesting direct deposit. If someone is entering an agreement about other methods to receive their refund, they should carefully review and understand information about that process before signing.

Ensure the preparer signs the return and includes their PTIN. All paid tax preparers must have a Preparer Tax Identification Number. By law, paid preparers must sign returns and include their PTIN on the return they file. The taxpayer’s copy of the return is not required to have the PTIN on it.

Report abusive tax preparers to the IRS. Most tax return preparers are honest and provide great service to their clients. However, some preparers are dishonest. People can report abusive tax preparers and suspected tax fraud to the IRS. Use Form 14157, Complaint: Tax Return Preparer.

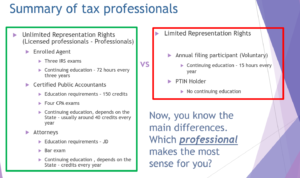

This is a relevant topic as during my tax educational presentations (i.e. Finanta and Laeda last month), the audience cannot differentiate the different tax professionals available. Keep in mind that there is no education requirement to obtain a PTIN (the PTIN is an IRS code that allows you to prepare tax returns for compensation)