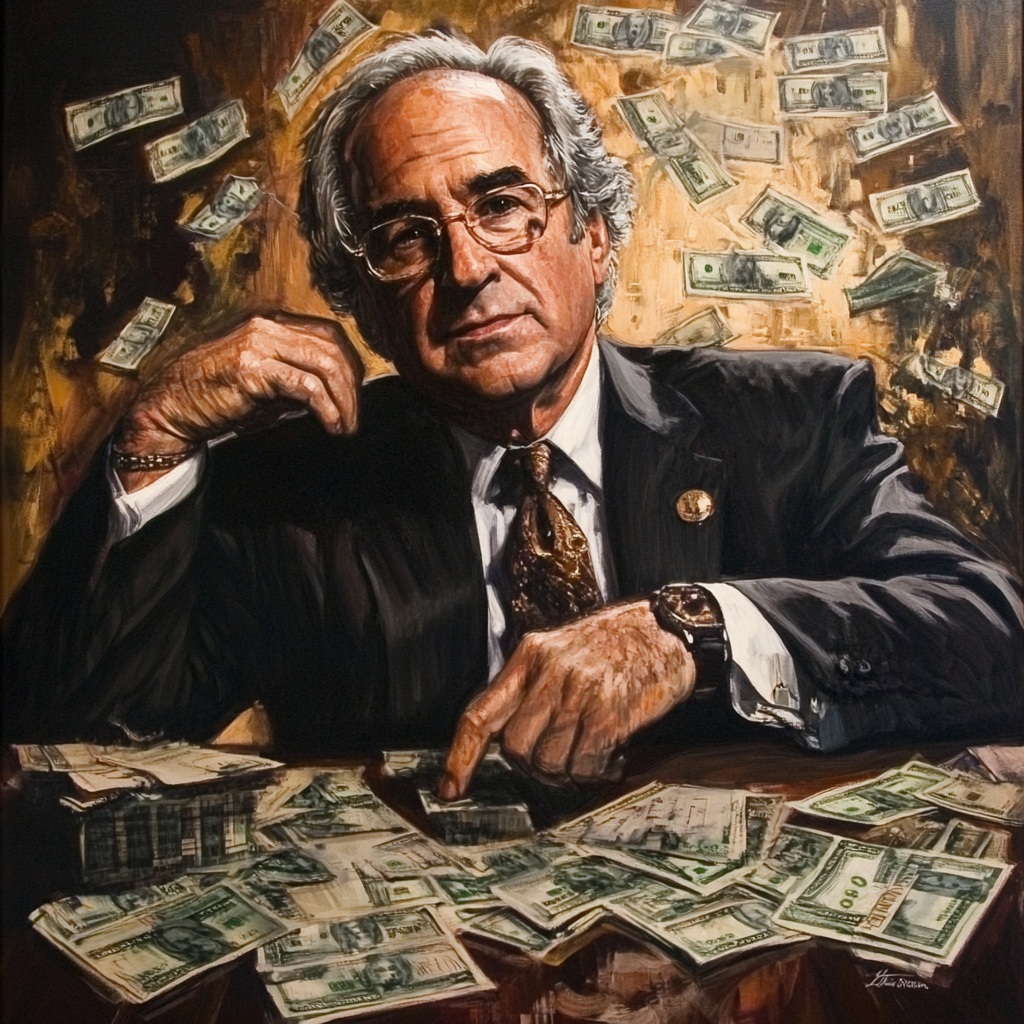

In early January 2024, the IRS updated the post titled Help for Victims of Ponzi Investment Schemes which makes references to the 2009 related guidance. Note that this guidance was released a year after the Bernard Madoff scandal.

In a normal case scenario if you have a loss in the value of a security (capital loss), you can offset against current capital gains and if the capital loss is in excess, then, you can deduct $3,000 in your 1040 and carry forward the remaining balance. If you do not have any capital gains in the future, then, you are limited to the $3,000 each year going forward. It will take potentially a long time going three thousand dollars at the time if no capital gains to offset it.

In the case of a Ponzi scheme, the loss is considered a casualty and theft loss and then, you can use the itemized deductions (if more beneficial than the standard deduction). The casualty and theft loss will be reported in form 4648 and it is subject to certain requirements.

It is important to consider that the loss will be deducted on the year that you were aware of the Ponzi scheme so in certain cases and amended might be necessary if already filed. Also, if you are a qualified investor, you might benefit from the use of safe harbor to deduct either 75% or 95% of the loss in the discovery year.

IRS – Ponzi Scheme Questions and Answers

IRS – Revenue Ruling 2009-9

IRS – Revenue Procedure 2009-20

The Tax Adviser – Deducting Ponzi Scheme Losses: Practical Issues